By Bai Ding Mar 13, 2024

Image source: Looking at China

Edtior’s note: While we preserve the links from the original Chinese-language article, most links are to Chinese-language sources.

1. China’s social-security funds face serious gaps between revenue and expenditures

Under the pressure of the increasingly obvious downward trend in China’s economy, more and more young people have begun to feel anxious about their lives after they retire. How to plan for future life security in the absence of basic social insurance today is a reality that ordinary Chinese people cannot escape.

A few years ago, Lin Caiyi, director of the China Economists Forum and chief economist of Hua’an Fund Management Company, issued a warning about China’s increasingly depleted social-security funds, saying they “are facing a serious revenue/expenditure gap.”

As the working population begins to shrink and the proportion of the population that is elderly grows faster, the annual contributions for the China Social Security Fund have been unable to support annual social- security expenditures. Even with existing fiscal subsidies, the pool of social- security funds is still shrinking at an accelerated pace. Lin Caiyi warned that as China’s economy enters a decline, such subsidies will be difficult to sustain. Once the subsidy ends, the fund will be unable to make payments on the current scale.

2. How big is the deficit in the social-security fund?

The fund was officially established in 2000, and its full name is the National Social Security Fund. According to the Chinese official narrative, it is a social-insurance fund established by the Chinese government to protect the basic social-insurance rights and interests of the public.

However, achieving this goal of protecting the public’s basic social-security rights and interests has begun to face increasing difficulties. According to national statistics, in 2013, not long after the establishment of China’s social-security fund, it experienced a deficit for the first time, that is, the social-security expenditure that year was greater than the payment income. This gap has since been expanding year by year. Starting from 12.2 billion yuan in 2013, after that reaching 300 billion yuan in 2015 and 600 billion yuan in 2018, the revenue/expenditure gap in China’s social-security funds reached 2.3 trillion yuan in 2020.

This rapidly expanding gap between social security revenues and expenditures has gradually shrunk the stock of China’s social-security funds accumulated during the first 10 years, thus threatening the already meager basic social security of the Chinese people.

3. Even with subsidies, social-insurance payments can barely be maintained

In order to maintain a minimum water level in the social-security pool, the Chinese government uses fiscal subsidies to maintain existing expenditures.

Take 2018 as an example. The fiscal subsidies from the social-security fund that year were 1.7 trillion yuan, accounting for 7.6% of public fiscal expenditure that year. By 2020, public-finance subsidies for social-security accounts grew to 2.1 trillion yuan, and the proportion of social-security financial subsidies in the government’s general public-budget expenditures rose to 11.49%.

In comparison, in China’s national fiscal expenditure this year, national defense accounts for about 5%, and general public services account for about 8%. It can be seen that the social security fund has completely turned into an institution that relies on subsidy to survive, rather than a social-security savings pool that can survive and grow through a virtuous cycle.

4. Where does the social-insurance subsidy come from?

If you live in China, even if you are not a financial professional you may be familiar with the various types of bonds issued by the central and local governments. In addition to being used to launch large-scale infrastructure projects, a large part of these bonds issued by the Chinese government is used to repay mature old debts and to subsidize China’s social-insurance funds. According to reports, Chinese governments at all levels issued a total of 7.3676 trillion yuan in local government bonds in 2022, including 2.236 trillion yuan in general bonds and 5.1316 trillion yuan in special bonds.

Due to various reasons such as the government’s “opacity with Chinese characteristics,” the outside world has no way of knowing what proportion of the Chinese government’s financial subsidies to social-insurance funds comes from local bond revenue. Given that China’s economy has entered a period of declining growth in recent years, especially after the outbreak of the Wuhan-pneumonia epidemic, it is very unlikely that governments at any level that are unable to make ends meet will use their dwindling fiscal revenue to subsidize social-security funds. Therefore, a large part of the government’s so-called financial subsidies to social-security funds may come from the aforementioned bond income. If this is indeed the case, then it is not the Chinese government but the Chinese people who directly or indirectly purchase the bonds that are really subsidizing China’s social-security funds.

Taking 2022 as an example. In order to repay 2.8 trillion yuan of maturing bonds throughout the year, local governments issued 2.4 trillion yuan of refinancing bonds to support debts. The local government’s debt interest payments for 2022 were 1.1 trillion yuan, an increase of 8.7% over the previous year, far exceeding the GDP growth rate that year. China’s “debt-to-pay-debt” model, due to its huge scale and continuing expansion, will eventually be overwhelmed by the huge interest costs. In the current Chinese financial environment where unlimited bond rollover has become the norm, bond holders who have inadvertently become the actual subsidizers of social-security funds may never be able to liquidate their bonds.

5. Will social insurance disappear?

Seeing these data, people will naturally worry, since government social security cannot sustain itself, will it disappear?

In fact, the real question that should be asked is not whether social security will disappear, but when.

According to reports, China’s social-security fund had a cumulative balance of 7.4 trillion yuan at the end of 2022. This amount may seem large, but the full-year social security expenditure in 2022 was 6.6 trillion yuan. The sustainability of the social-security fund can be estimated by dividing the total balance of social-security funds by the amount of annual fund expenditures. Calculated according to this formula, based on the current (2022 data) total balance of the National Social Security Fund and total annual expenditures, China’s social-security expenditures can only last for 13 months. Of course, the income of and expenditure on social-security funds in economically developed areas is better than that in economically underdeveloped ones. At present, the province with the most sustainable social-security funding is Guangdong Province, but its social-security expenditures are sustainable for less than 5 years (52 months). The regions with the least-sustainable social-security funds are the three northeastern provinces, whose social-security spending capacity was already zero before 2018.

The Chinese government has already realized that the social-security model that relies entirely on financial subsidies is unsustainable. Social-security reform is now being accelerated. It can be seen from the current reform plan that the government is gradually reducing social-security expenditures while encouraging the working population to continue to pay social-security fees.

As we all know, social security consists of six parts, also known as “five insurances and one housing fund.” However, most people may not understand the respective proportions of these six parts in social-security expenditures. Among these expenditures, pensions and medical-insurance expenditures account for the vast majority (96%), of which pension payments alone account for 70%. The remaining three insurance programs and one fund (that is, unemployment insurance, maternity insurance, disability insurance and the provident fund for housing) together only account for 4% of social-security expenditures.

Thus, if the Chinese government wants to reduce its social-insurance expenditures, the most effective method will be to reduce pension payments and medical-insurance spending.

In fact, the social-security reform measures that have been introduced do include extending the retirement age and thus the time at which pension payments will begin to be made. The most important reform is the introduction of personal pension plans. “You cannot rely on the government for pensions” is no longer just a slogan, a warning. In numerous places there have been incidents of retirees’ pensions being interrupted.

6. China’s current social security fund as a Ponzi scheme

The definition of a Ponzi scheme is using the funds of subsequent investors as investment returns to reward early investors, thereby creating the illusion of profit and deceiving more investors to join. The fundamental difference between it and real investment is that the Ponzi scheme does not maintain healthy operation and growth of funds through legitimate investment profits, but through “destroying the east wall to pay for the west wall,” which is the current practice in China of issuing debt to support existing debt. Since the number of new investors will not grow indefinitely, the Ponzi scheme will collapse when the source of investors dries up.

The decline in the working population in China means the source of new investors is in fact drying up. The emergence of a gap between income and expenditure in China’s social-security funds marks the beginning of the collapse. The Chinese government, knowing full well that the social-security fund is no longer viable, continues to encourage and even coerce the public to participate. China’s social-security funds and the social security system itself have shown all the hallmarks of a Ponzi scheme.

7. Facing the collapse of China’s social security, how should ordinary working-class and rural people respond?

Faced with the imminent collapse of China’s social-security system, the general public’s response mainly depends on the nature of current and future employment.

The first group of people to think about are the urban self-employed. The number in this group is increasing year by year. For them, the response is simple: keep only health insurance. China’s current social-security policy allows individuals to pay for medical insurance and pension insurance at their own expense. If you choose to participate in “Social Security for Urban and Rural Residents” insurance, the two insurances can be split and do not have to be bundled and paid for together.

The annual premium in the “Urban and Rural Residents Medical Insurance” program is less than RMB 1,000.

The second group of people is working people who are employed by others. The size of this group is shrinking due to wave after wave of layoffs. In principle, they should only keep medical insurance. For specific operations, they can refer to the following steps:

-First, determine the specific content of the five insurances and the one housing fund.

– Then, negotiate with the employer to pay the portion of medical insurance and pension insurance that will be withheld from wages.

– Pay the “Urban and Rural Residents Medical Insurance” at your own expense. (The procedure is the same as that for people who choose their own jobs.)

– If you do not want to give up participating in the housing provident fund, you can negotiate a payment agreement with your employer. (But with the current extremely high housing prices and inventory, participating in the housing provident fund has no practical significance).

The “slimming down of social security” referred to above can not only increase the salary received by 10% (i.e., the self-paid part of the five insurances), but also save the employer 28% of salary expenses (i.e., the employer-paid part of the five insurances, respectively: 19%, 8%, 0.2%-1.9%, 0.5%, 0.7%). In the current environment of economic downturn and corporate capital shortage, this plan to downsize social security will receive active cooperation from most employers.

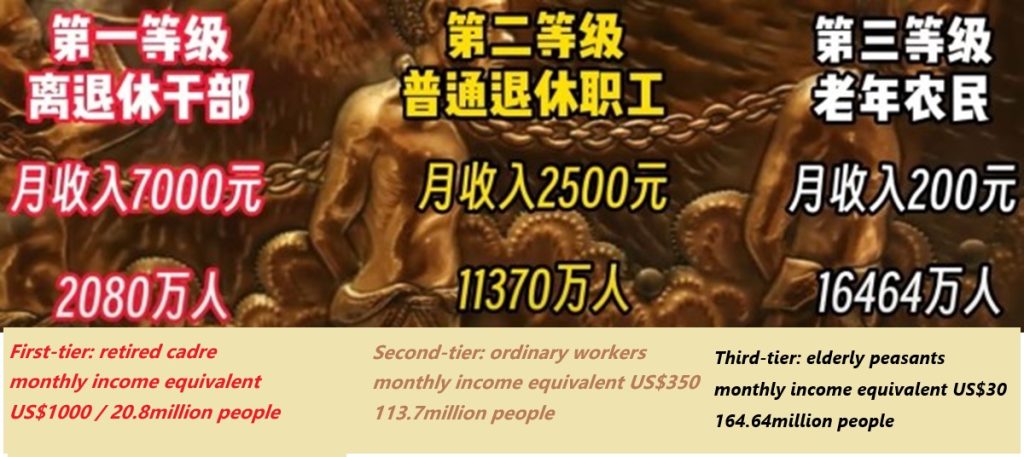

The third group is the rural population. They currently make up the largest share of the working population in China, but they are also the group that receives the least social benefits. In 2009, China’s rural population was informed for the first time that their pensions had finally changed from nothing to something. That year marked 60 years, or two generations, since the CCP established its “people’s democratic regime.”

Although China’s rural population thus now has a pension in name, the amount is pitifully low. According to the “Statistical Bulletin on the Development of Human Resources and Social Security in 2022,” the average monthly pension received by the rural elderly in 2022 is about 204 yuan, which is less than 10% of the pension of retired urban employees.

But the reality is probably worse than that. As of the date of publication, China’s official minimum standard for a basic pension is only 123 yuan (i.e., the previous minimum standard of 103 yuan plus the just promised increase of 20 yuan). Among China’s rural population, there are still many people who are not covered by pension insurance. Even if they are eligible for pensions, the pensions that many people can receive are still too low to maintain a minimum standard of living in rural areas. (In 2020, the average minimum secure-living standard in rural areas across the country was 5,962 yuan per year, or 496.8 yuan per month.)

Although the pension that China’s rural population can receive is very small, in order to receive even this pension, a farmer must first pay for 15 years of pension insurance (full name “National Urban and Rural Resident Pension Insurance”). Otherwise one can only receive a basic pension, 100 yuan. Therefore, the current pension for the rural population simply does not play the role of providing old-age security for farmers.

Obviously, the vast majority among China’s rural population faces participation fees that are high relative to their annual income, and extremely low pension returns relative to these premiums. The policy-based discrimination against the rural population, which has not changed in 70 years, is one of the fundamental reasons why China’s rural population has no way to provide for its elderly.

For China’s rural population, participating in the current pension insurance is not worth it. What they should do, like the two urban population groups above, is try to avoid wasting money on pension insurance.

Considered in total, and taking into account that China’s current social and economic conditions are deteriorating and will not improve in the short term, the Chinese government’s financial support for social-security funds may be terminated at any time as its finances become increasingly tight. Once financial support is lost, China’s social-security system will collapse and retirement funds will quickly be completely exhausted. Therefore, the general public (urban and non-urban residents alike) who still place their hope on China’s retirement insurance system should re-adjust their expectations for their own future economic security and the countermeasures they should take to protect themselves as much as possible.

This piece was translated from Yibao Chinese. If republished, please be sure to add the source and link https://www.yibao.net/?p=247795&preview=true before the text when reposting.