By Nada Ling and Evan Osborne

Charlie Munger was a lengendary stock-market investor. He was the right-hand man to Warren Buffett and the vice chairman of the Berkshire Hathaway. Munger helped Buffett to pivot from pure value investing to “buy quality companies at good prices,” thus enabling Berkshire Hathaway’s market-beating return over multiple decades. He passed away in November 2023 at the age of 99.

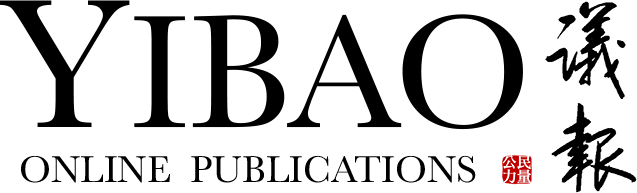

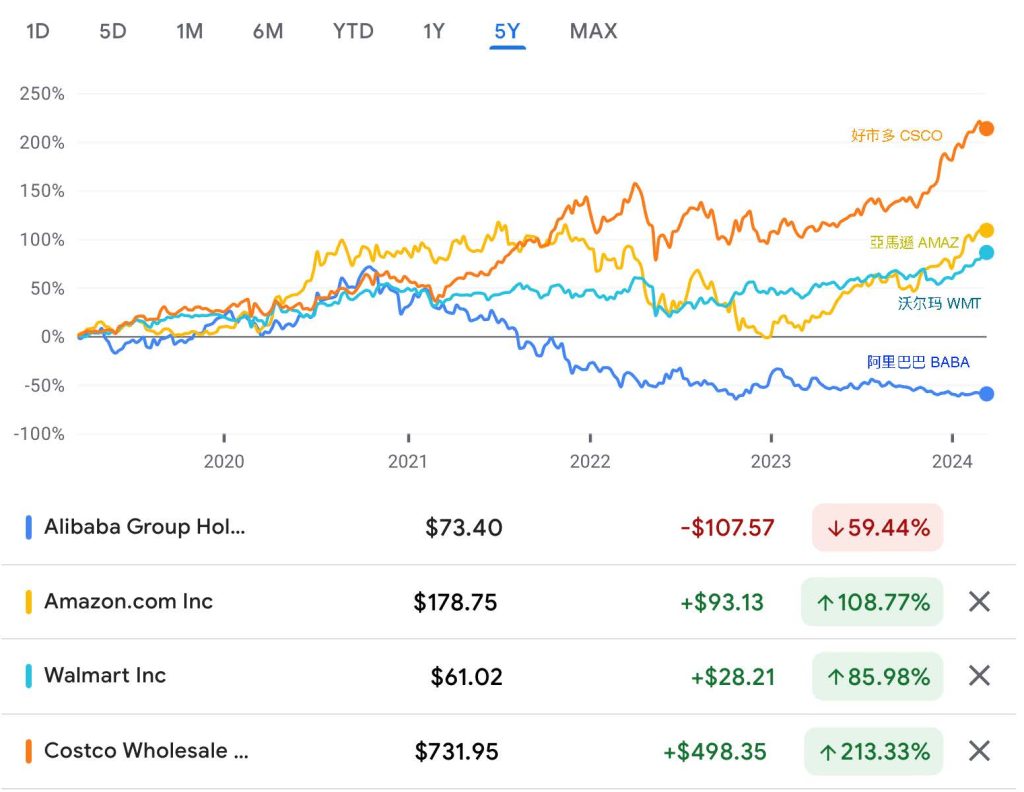

*Five-year total return (2019/03 to 2024/03)

The Alibaba Group (BABA): -59%

Amazon.com Inc (AMAZ): +109%

Costco Wholesale Corp (COST): +213%

Walmart Inc (WMT): +86%

The late Charlie Munger was long an investor in the Chinese stock market. He encountered both with great success (the electrical car maker – BYD) and tremendous blunder (the internet conglomerate – Alibaba).

Given the persistent sell-off of Chinese stocks over the past three years, with a staggering loss of $6 trillion dollars, it is illustrative to study Munger’s investments in China. His adventures in Chinese equities provide a lesson in the fundamental forces that underlie stock valuation. It is commonly accepted that long-term stock performance is based on the reliability of a company’s future earning power. But in quasi-totalitarian China, where the Chinese Communist Party (CCP) tolerates a simulacrum of private economic activity but only as long as it does the Party’s bidding, Munger’s mixed experience provides insights into Chinese politics and its state-mandated economic policies, which more than ever have the potential to either boost or devastate companies or sectors.

With regard to Alibaba in particular, In Munger’s own words, “I regard Alibaba as one of the worst mistakes I ever made.” The short summary of his error, according to Munger, was that “I didn’t stop to realize they’re still a goddamn retailer.”

In brief, the Alibaba group is the Amazon.com of China. It pioneered early online commerce in the Chinese market. As Internet commerce grew exponentially, the company further dominated the cloud-hosting business just like Amazon has done with its AWS (Amazon Web Services). However, as of March 2024, Amazon has a market capitalization of 1800 billion which is ten times bigger than Alibaba’s 184 Billion. If Munger’s characterization as a “goddamn retailer” applies to Alibaba, then it certainly applies to Amazon too. Moreover, Munger loved Costco, another retailer that has provided impressive compound returns to investors, and even served on the company’s board of directors. Thus, clearly, being a retailer was no obstacle to delivering tremendous value for shareholders and Munger knew this well (see chart for comparison of retailer stock returns for the past 5 years). Either his explanation was incomplete, or he chose not to be direct with his words, which was very atypical of Munger style.

Jack Ma (马云 in Chinese), one of the founders of the Alibaba group, was the richest person in China at one point. As reported by many, the company’s and Ma’s downfall started when Ma criticized CCP financial regulators in 2020. Jack Ma was lucky in the sense that he didn’t face more penalties other than hits to his personal net worth, including having to “donate” a significant part of the Alibaba group (Ant Financial) to the government. Was Munger blinded by this political risk when investing in Alibaba? He should not have been, as there were countless precedents of business executives being jailed and their properties seized for speaking up. For example, other Chinese tycoons such as the realty developer Ren Zhiqiang was sentenced to life in prison after he called out Chinese Communist Party (CCP) Chairman Xi as an emperor-wannabe.

Political risks to companies, top executives, and investors cannot be overlooked anywhere, least of all in today’s China. They are akin to catastrophic risks in the insurance business. Munger, who was a master in applying the notion of “margin of safety” analysis to protect against potential downsides of an investment, might have been too sanguine in his risk assessment of the overall Chinese business environment. It is already a hard job to pick market-beating individual stocks, as most active fund managers fail. To account for unpredictable political risk in China was a tough hurdle to overcome, even for an investment legend like Charlie Munger.

The Berkshire Hathaway investment vehicle run by Buffett and Munger is famous for its insurance and reinsurance business. To preserve capital, it is essential to take only calculated risks; this is true in both underwriting insurance policies and investing in stocks. Thus, it was surprising that Munger didn’t account for Chinese political risk, a form of catastrophic risk that could wipe out stockholders’ equity at the behest of the CCP without warning or, if such were to happen, recourse. This is because if any decision is challenged via the legal system, the courts are just another arm of the Party.

One possible explanation could be that Munger had hit a homerun with his BYD investment, which might have clouded his overall risk assessment of investing in Chinese companies. He even praised the Chinese government in silencing Alibaba’s Jack Ma. This is a fundamental flaw in Westerns understanding of Chinese politics. When the CCP decides to silence someone, that person doesn’t just lose a platform to speak out. Instead, his/her entire fortune, livelihood and personal freedom are instantly at the mercy of the Party. By extension, since Jack Ma was the face of Alibaba ever since his company’s founding, his company suffered the same fate as well as Alibaba investors.

Such political risk should be on the radar of all investors when it comes to Chinese investments. As of late 2023, foreign holdings had withdrawn more than $188 billion from the Chinese stock market. In March 2024, Goldman Sachs Wealth Management CIO commented bluntly that “one should not invest in China.” While democratic voting isn’t available in China, the flow of money is a most succinct form of voting. In recent years, the answer has been a resounding NO!

* Nada Ling is a casual investor, and observer of the stock market and macro-economics.

* Evan Osborne Ph.D., is a professor of economics at Wright State University and the author of “Reasonably Simple Economics: Why the World Works the Way it Does” and “The Rise of the Anti-Corporate Movement: Corporations and the People Who Hate Them.”